"The only limit to our realization of tomorrow will be our doubts of today."

– Franklin D. Roosevelt

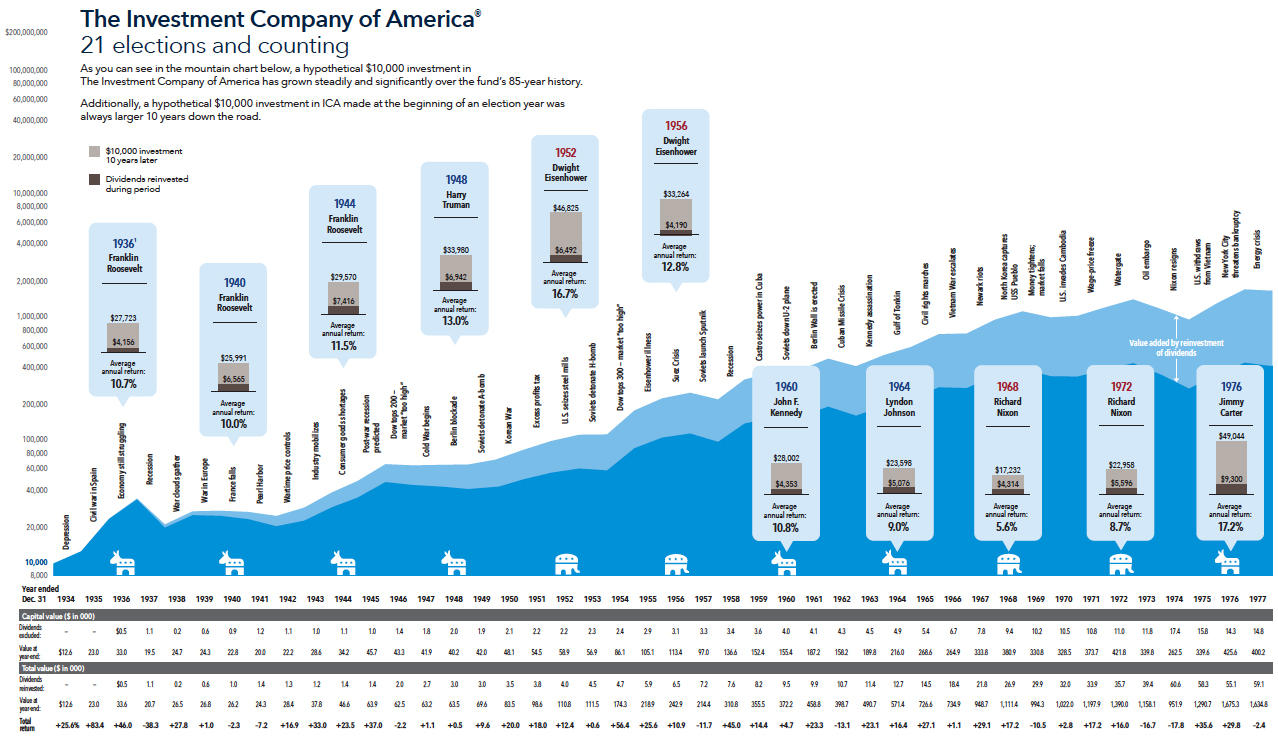

Set your sights on the long term

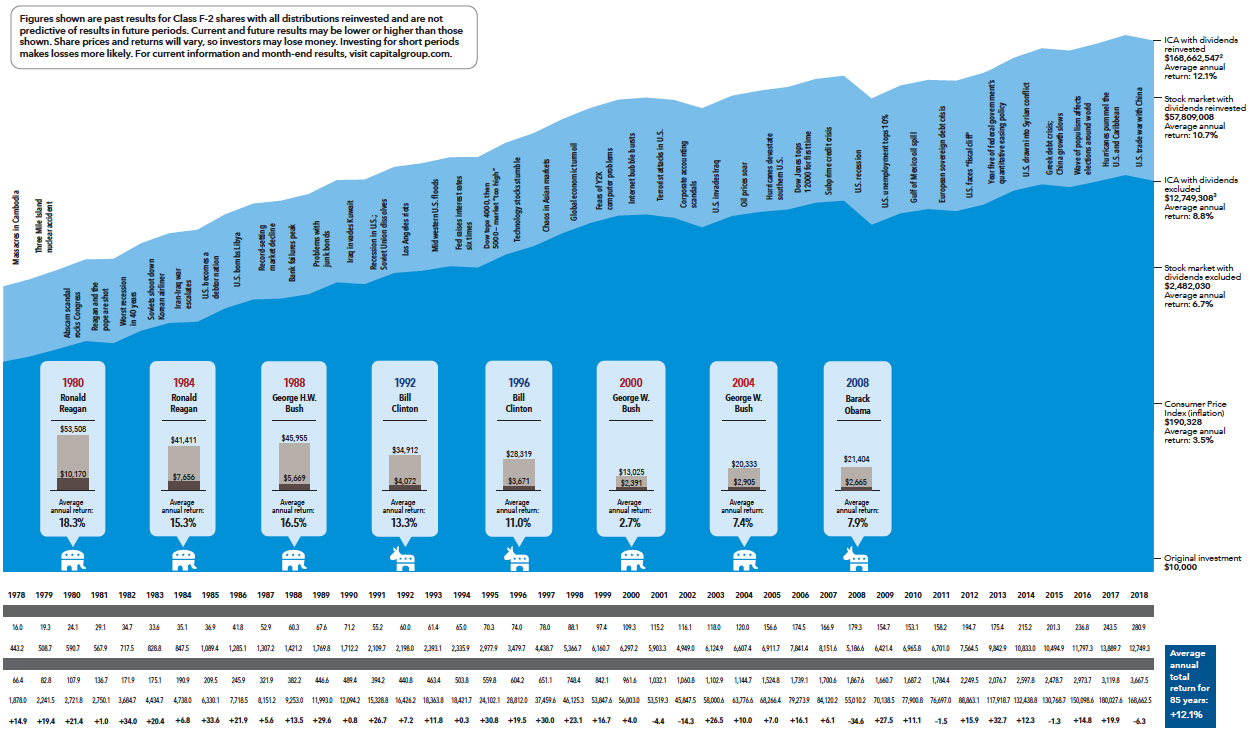

Investor doubts may seem especially prevalent during presidential election years when campaigns spotlight the country’s challenges. Yet even with election year rhetoric amplifying the negative, it’s important to focus on your vision for the future.

Keep in mind the following:

- Successful long-term investors stay the course and rely on time rather than timing.

- Investment success has depended more on the strength and resilience of the American economy than on which candidate

or party holds office. - The experience and time-tested process of your investment manager can be an important contributor to your long-term investment success.

Sources: Capital Group, Standard & Poor’s. Dividend calculations sourced from Refinitiv InvestmentView+.

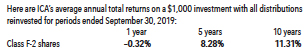

Class F-2 shares were first offered on August 1, 2008. Class F-2 share results prior to the date of first sale are hypothetical based on Class A share results without a sales charge, adjusted for estimated annual expenses. The results shown are before taxes on fund distributions and sale of fund shares. Past results are not predictive of results in future periods. Results for other share classes may differ.

Expense ratio was 0.39% as of the fund’s prospectus available at the time of publication.

When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would be lower. Please see capitalgroup.com for more information.

The stock market is represented by Standard & Poor’s 500 Composite Index, a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

1 Investment results shown are for 10-year periods beginning on January 1 of the year shown.

2 Includes dividends of $45,282,202, and capital gain distributions of $95,798,465, reinvested in the years 1936–2018.

3 Includes reinvested capital gains of $9,258,017, but does not reflect income dividends of $4,562,617 taken in cash.

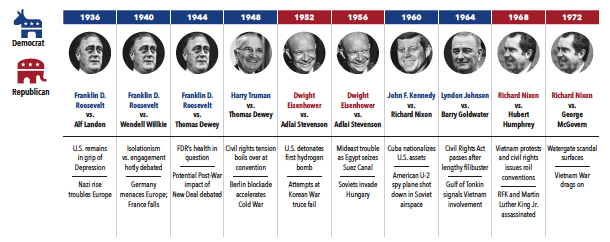

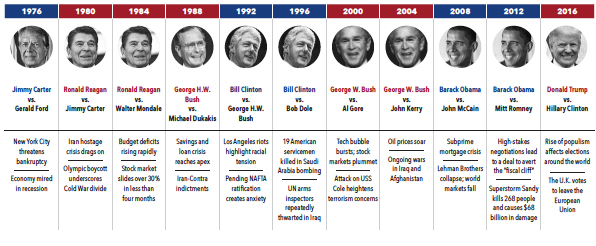

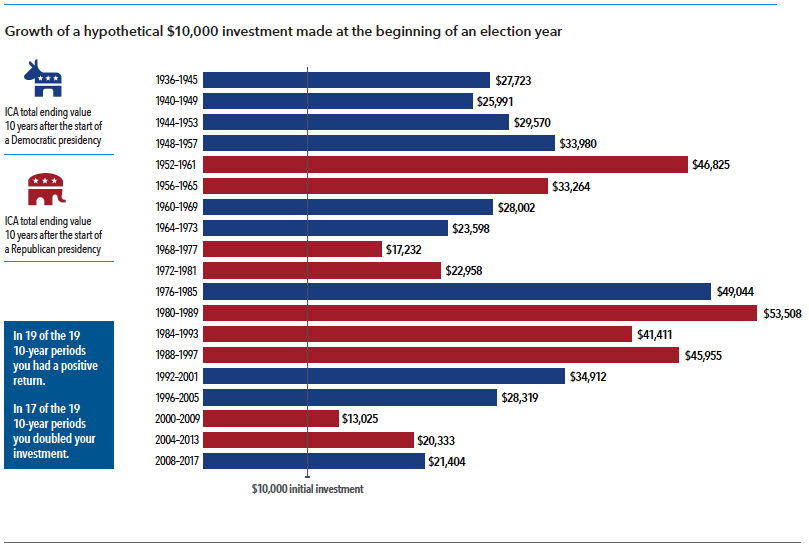

Red, blue and you

Beliefs about which political party is best for the markets might discourage you from investing. But as you can see from the chart, whether a Republican or a Democrat claims victory hasn’t been a deciding factor in how a $10,000 investment made at the beginning of an election year looked 10 years down the road.

Source: Capital Group.

Each 10-year period begins on January 1 of the first year shown and ends on December 31 of the final year shown. For example, the first period listed (1936–1945) covers 1/1/36 through 12/31/45.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectus and summary prospectus, which can be obtained from a financial professional and should be read carefully before investing.

If used after December 31, 2019, this brochure must be accompanied by a current American Funds quarterly statistical update.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

American Funds Distributors, Inc., member FINRA.

Maggie Slivinski

Maggie Slivinski Steve Corbo

Steve Corbo Alexandra Rao

Alexandra Rao Alexa Comey

Alexa Comey Gene Donato

Gene Donato Jack W. Kennedy III, CFP®, AAMS®

Jack W. Kennedy III, CFP®, AAMS® Henry (Hank) J. Schroeder, CFP®

Henry (Hank) J. Schroeder, CFP® Diane Gallagher

Diane Gallagher Scott Bernstiel

Scott Bernstiel Chrissy Carpenter

Chrissy Carpenter David Strout

David Strout Keith R. Hering AAMS®, CRPS®, CIMA®

Keith R. Hering AAMS®, CRPS®, CIMA®  Marjorie Onuwa

Marjorie Onuwa